flow-through entity tax form

One particular flow-through compliance concern is the existence of complex structures of related entities. 5376 on December 20 2021 enacting a flow-through entity tax for those doing business in Michigan.

Complying With New Schedules K 2 And K 3

The income and losses are already classed and apportioned for Pennsylvania purposes as reported on the Schedule RK-1 and NRK-1.

. If you own a business chances are that you not the business itself are responsible for paying taxes on the profit generated by the business. 653001210094 Department of Taxation and Finance IT-653 Pass-Through Entity Tax Credit Tax Law Section 606kkk 1Add column C amounts see instructions. Because your business pays its taxes through your individual tax return it is known as a pass-through entity.

Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US. Through entity receiving a payment from the entity I certify that the entity has obtained or will obtain documentation sufficient to establish each such intermediary or flow-through entity status as a participating FFI registered deemed-compliant FFI or FFI that is. Information about Form W-8 IMY Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US.

Retroactive to tax years beginning on or after Jan1 2021 the law allows eligible entities to make a valid election and file and pay tax at the entity level giving a deduction against entity taxable income. A flow-through entity is also called a pass-through entity. Effective January 1 2021 the Michigan flow-through entity FTE tax is levied on certain electing entities with business activity in Michigan.

September 2016 Department of the Treasury Internal Revenue Service. The flow-through entity tax annual return is required to be filed by the last day of the third month after the end of the taxpayers tax year. Flow-through entities are different from C corporations they are subjected to single taxation and not double taxation.

A pass-through entity is any type of business that is not subject to corporate tax. California Senate bill proposes pass-through entity tax January 2021 Connecticut enacts responses to federal tax reform affecting corporations pass-through entities and individuals June 2018 Connecticut issues Pass-Through Entity Tax guidance. Form W-8 IMY may serve to establish foreign status for purposes of sections 1441 1442 and 1446.

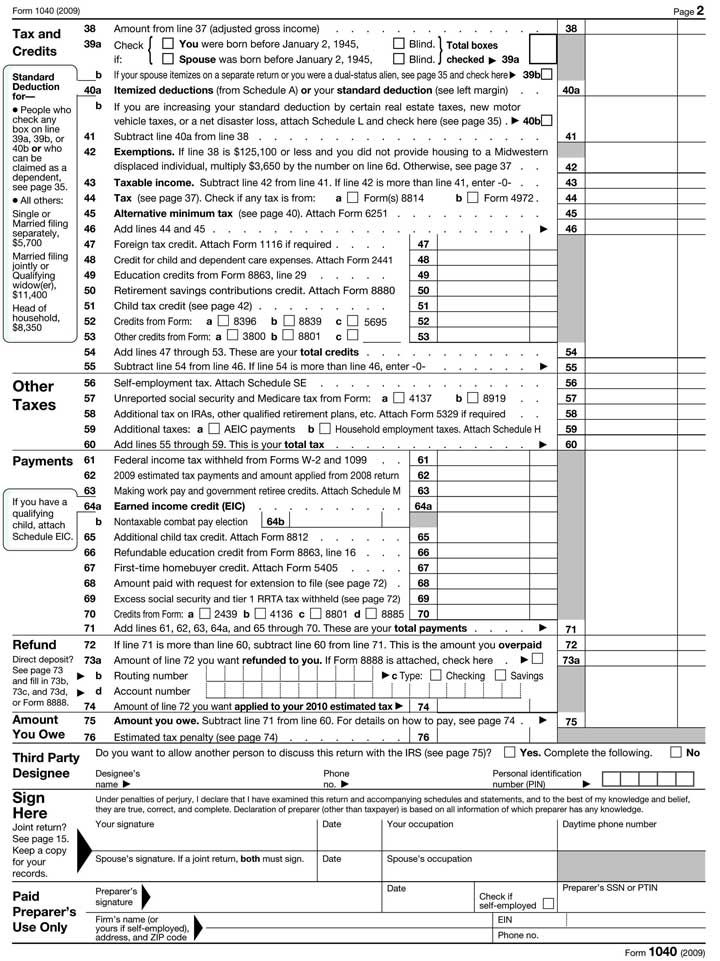

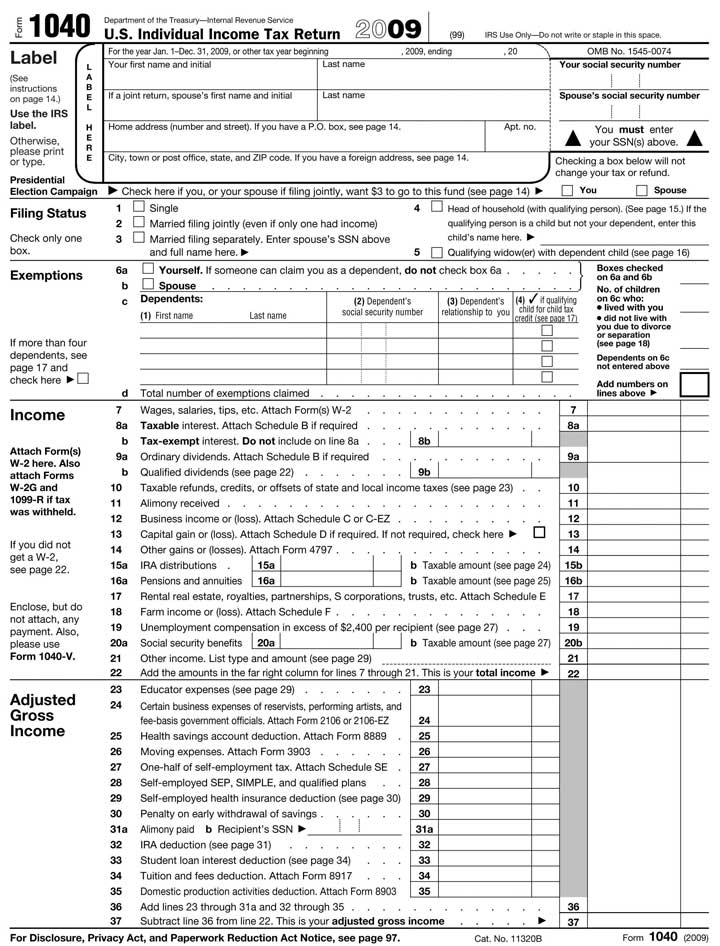

This amount generally correlates to the business income attributed to members who will. Owners report their share of income on their personal tax return Form 1040. When they do the result is a structure with multiple layers.

Pass-through entities also called flow-through entities roughly follow the same tax-paying process. Instructions for 2021 Fuel Retailer Supplemental Schedule. Gretchen Whitmer signed legislation on Dec.

Questions rema in September 2018. Instructions for 2021 Vehicle Dealer Supplemental Schedule. As part of the electronically filed Schedule 3K-1 and SK-1 forms the pass-through entity will be asked to provide information identifying the member as an.

Instructions for 2021 Sales Use and Withholding Taxes 4 and 6 Annual Return. The information in this section also applies if for the 1994 tax year you filed Form. Information about Form W-8IMY and its separate instructions is at.

To make a PTE elective tax payment by printing the voucher from FTBs website and mailing it to FTB. Branches for United States Tax Withholding and Reporting including recent updates related forms and instructions on how to file. The following are all pass-through entities.

Income From Pass Through Entities. Refunds received under the flow-through entity tax or city income tax Income from the production of oil and gas Income derived from a mineral Miscellaneous subtractions. Branches for United States Tax Withholding and Reporting.

The income of the owners of flow-through entities are taxed using the ordinary. Pass Through entities must provide to its entity owners a Schedule RK-1 and NRK-1 detailing the entity owners share of pass through income and losses during the taxable year. 2021 Flow-Through Entity Tax Annual Return Form Warning Save functionality for FTE returns is forthcoming in the meantime enter all return data in one session.

This legislation was passed as a workaround to the federal 10000 state and local tax deduction limitation that has frustrated many business owners since it was passed in 2017 as part of the Tax Cuts and Jobs Act. This section provides information on the types of investments that are considered flow-through entities and how to calculate the capital gain and loss resulting from the disposition of shares of or interests in a flow-through entity. Flow-throughs are also a growing tax compliance concern.

Generally the flow-through entity tax allows certain flow-through entities to elect to file a return and pay tax on income in Michigan and allows members or owners of that entity to. Section references are to the Internal Revenue Code. A pass-through entity is an entity whose income loss deductions and credits flow through to members for Massachusetts tax purposes.

Electing flow-through entities may be required to pay quarterly estimated tax payments. For calendar filers that date. Form W-8IMY Rev.

Many flow -through entities are allowed to allocate income to other flow-throughs. Governor Whitmer signed HB. In December 2021 Michigan amended the Income Tax Act to enact a flow-through entity tax.

Entities can also use the Pass-Through Entity Elective Tax Payment Voucher FTB 3893 6. 1 00 Schedule A Pass-through entity tax PTET paid on your behalf see instructions Submit this form with Form IT-201 IT-203 or IT-205. For calendar year flow-through entities that have elected into the tax the fourth quarter.

Form W-8 IMY may serve to establish foreign status for purposes of sections 1441 1442 and 1446. Is elected and levied on the Michigan portion of the positive business income tax base of a flow-through entity. The Michigan flow-through entity tax which was signed into law on December 20 2021 is retroactive to January 1 2021 for certain electing flow-through entities.

Owners can claim a refundable tax credit. Reporting Non-electing Flow-Through Entity Income Form 5774 Schedule for Reporting Member Information for a Flow-Through Entity Do not send copies of K-1s. Instructions for 2021 Sales Use and Withholding Taxes Amended MonthlyQuarterly Return.

Entities can use Web Pay to pay for free and to ensure the payment is timely credited to their account. The income of the business entity is the same as the income of the owners or investors.

Form Your Own Limited Liability Company 7th Edition Ebook In 2021 Limited Liability Company Liability Online Marketing

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Tax Return Income Tax

Tax Planning For New Businesses Tax Accountants Business Tax Tax Accountant Tax Return

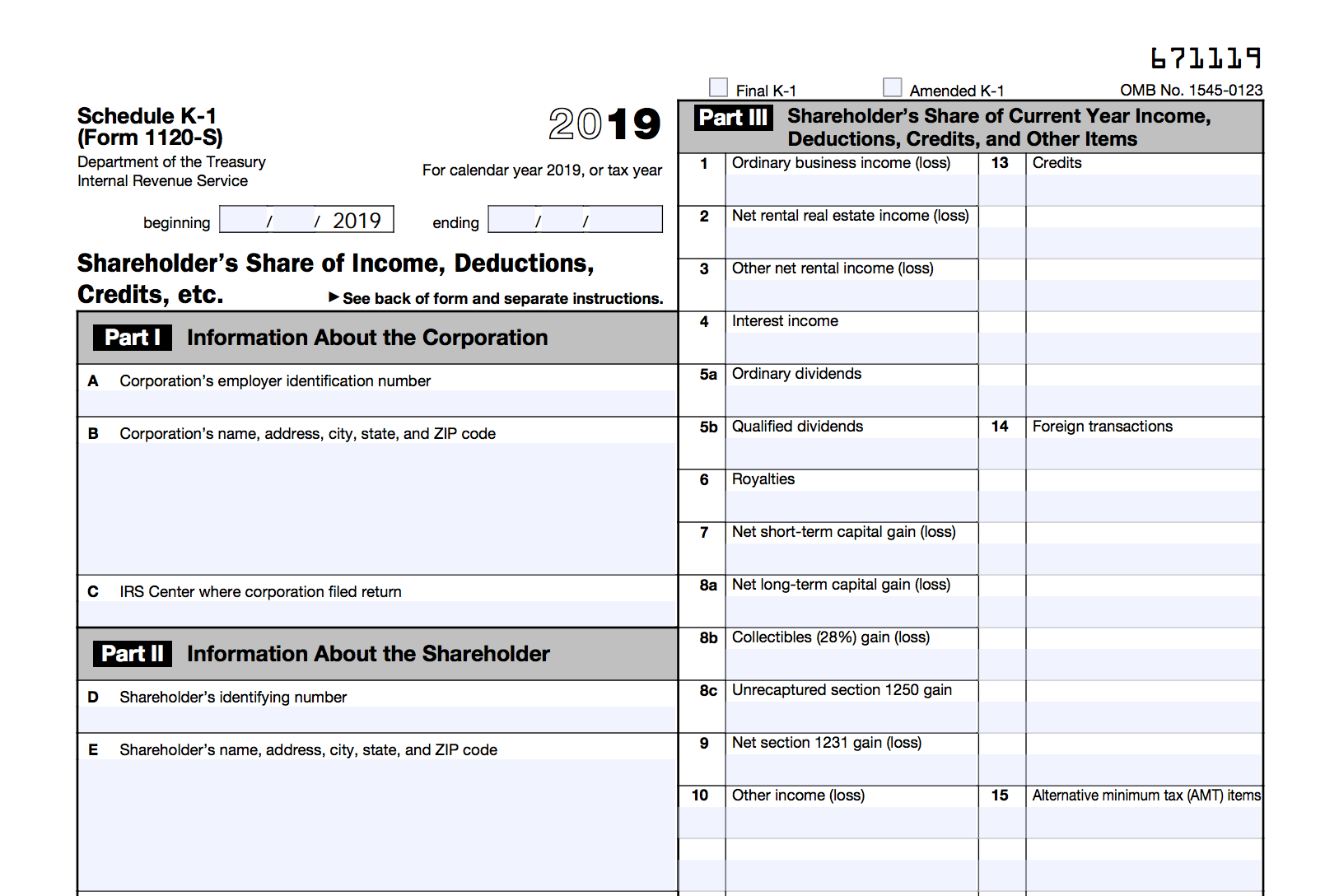

Schedule K 1 Tax Form What Is It And Who Needs To Know Tax Forms Income Tax Filing Taxes

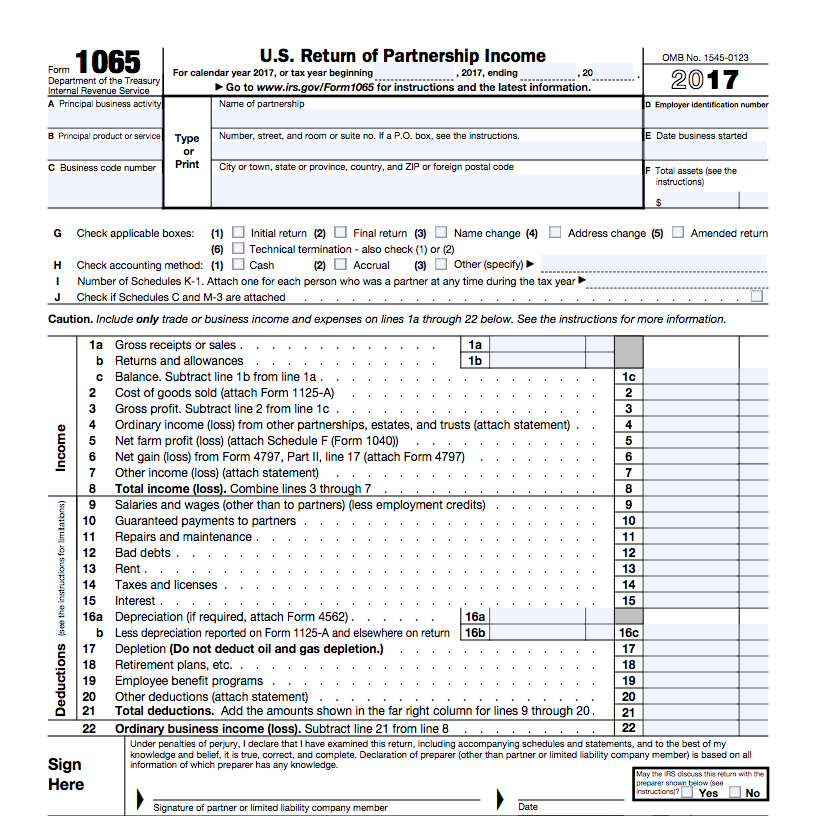

Form 1065 Instructions Information For Partnership Tax Returns

:max_bytes(150000):strip_icc()/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)

Form 1040 U S Individual Tax Return Definition

Schedule K 1 Tax Form Here S What You Need To Know Lendingtree

:max_bytes(150000):strip_icc()/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

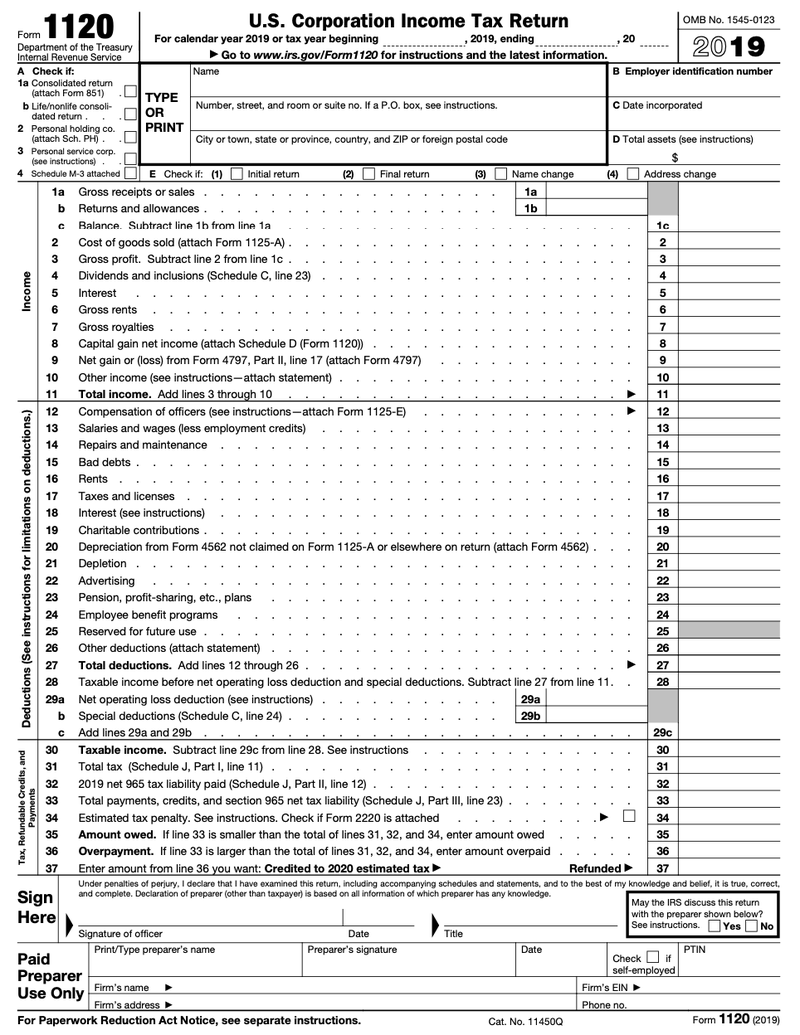

Form 1120 S U S Income Tax Return For An S Corporation Definition

How To File Tax Form 1120 For Your Small Business

The U S Federal Income Tax Process

S Corporation Is Taxed As A Flow Through Entity This Means Taxes Are Levied On The Income Of The Shareholders Instead S Corporation Business Venture Corporate

Filing A Schedule C For An Llc H R Block

Understanding The 1065 Form Scalefactor

How To Start An Llc In Nevada Llc Business Annual Report Estate Planning

Complying With New Schedules K 2 And K 3

Infographic Corporation Vs Llc Accounting Classes Business Entrepreneurship Class

How To Fill Out Form 1065 Overview And Instructions Bench Accounting